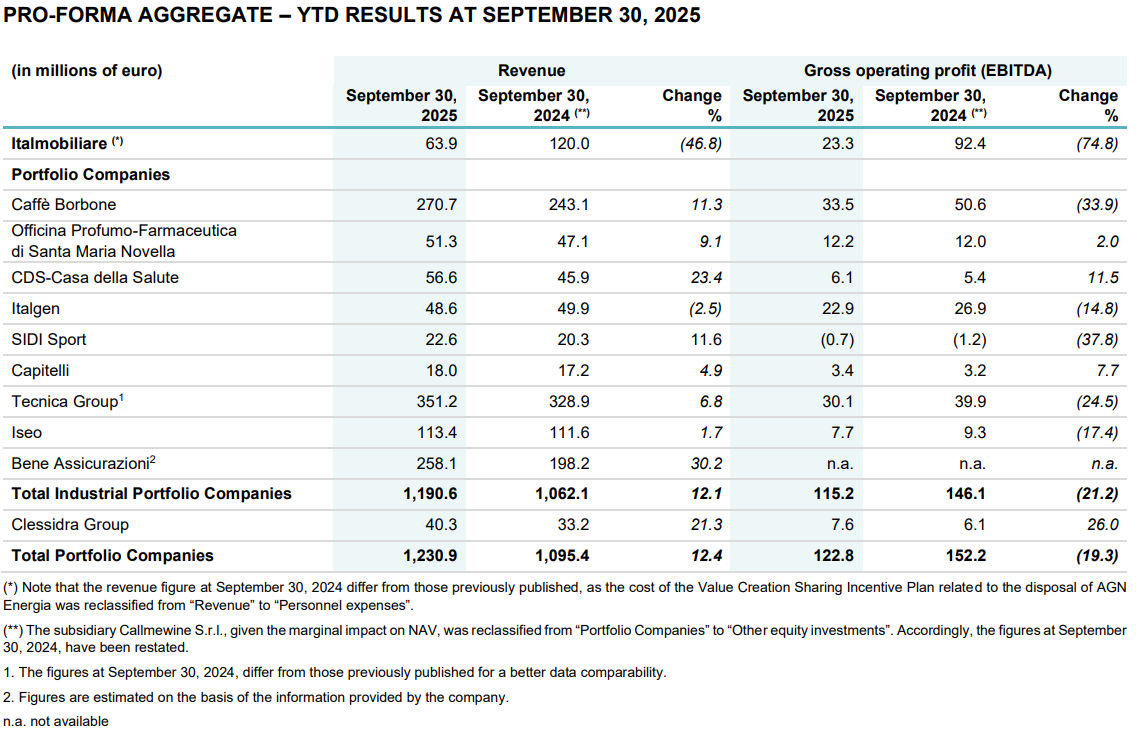

AGGREGATE REVENUE FOR THE ITALMOBILIARE GROUP IN THE FIRST NINE MONTHS HAS RISEN TO 1,190.6 MILLION EURO (+12.1%) WITH EBITDA SLIPPING TO 115.2 MILLION. NAV STABLE AT 2.2 BILLION WITH ITALMOBILIARE'S NFP POSITIVE AT 206.8 MILLION.

In a challenging macroeconomic context, in the first nine months of the year, the industrial investments in the portfolio recorded aggregate revenue of 1,190.6 million euro, up by 12.1% compared with the same period in 2024. Revenue increased for all Portfolio Companies with the exception of Italgen: it turned in an excellent performance, but it is being compared with a 2024 that featured exceptional rainfall that pushed hydroelectric power output to record levels. The aggregate gross operating profit of the industrial investments amounted to 115.2 million euro, down by 21.2%, primarily due to the contraction in EBITDA of Caffè Borbone, whose performance, like that of the entire sector, is being affected by the extremely high cost of its raw material, and of Tecnica.

Looking at the performance of the main industrial Portfolio Companies, revenue increased to 270.7 million euro (+11.3%) for Caffè Borbone, whose EBITDA fell to 33.5 million euro. The leading brand in single-serve products in Italy by sales volume, the company is performing well across all sales channels and continues to grow internationally. Officina Profumo-Farmaceutica di Santa Maria Novella turned in revenue of 51.3 million euro, an increase of 9.1% thanks to the excellent performance of the retail channel (+14.4%) and online (+18.6%). EBITDA went up to 12.2 million euro (+2%). CDS-Casa della Salute's revenue and EBITDA both grew by double digits, reaching 56.6 million euro (+23.4%) and 6.1 million euro (+11.5%) respectively. Thanks to the new openings, the company has reached a total of 40 clinics in Liguria, Piedmont, and Sardinia. Italgen continued to grow, and by the end of the year will complete construction of two photovoltaic plants, bringing the company's total production capacity to over 100 MW. Capitelli posted revenue of 18 million euro (+4.9%) and growth in EBITDA of 7.7% to 3.4 million euro.

During the period, the Group implemented its sustainable strategy, structured around four macro areas of action: governance across the entire value chain, a climate strategy aimed at net-zero emissions, a safety culture aimed at achieving zero accidents, and inclusive human capital development. In particular, the activation of "flagship projects" has allowed a further acceleration of the transformation processes applied to all companies in the portfolio.

The Net Asset Value of Italmobiliare, excluding treasury shares, at September 30, 2025, is equal to 2,197.1 million euro (2,215.8 million euro at December 31, 2024); Considering the dividend distribution made during the period of 38.0 million euro and the buy-back for 6.1 million euro, the net performance is positive by 25.4 million euro. The NAV per share is equal to 52.2 euro and, considering the distribution of dividends of 0.9 euro per share, shows an increase of 1.4% compared with the same figure at December 31, 2024. The buyback of treasury shares in the third quarter also contributed to the increase. Neutralising this effect, the increase would have been 1.1%, in line with the performance of NAV.

At September 30, 2025, Italmobiliare S.p.A.'s net financial position is positive at 206.8 million euro (273.8 million euro at December 31, 2024). Among the main outflows we would highlight the payment of the ordinary dividend (-38 million euro), the investments to support the development of portfolio holdings (-43.7 million euro) and the investment of private equity funds (-12.1 million euro), net of reimbursements.

PERFORMANCE OF THE MAIN GROUP COMPANIES