ITALMOBILIARE CLOSES ANOTHER POSITIVE YEAR: GROWTH IN TURNOVER (+19.7%) AND EBITDA (+58.5%) AT CONSOLIDATED LEVEL. CASH RESERVES UP TO 273.8 MILLION. PROPOSED DIVIDEND OF 0.90 EURO PER SHARE.

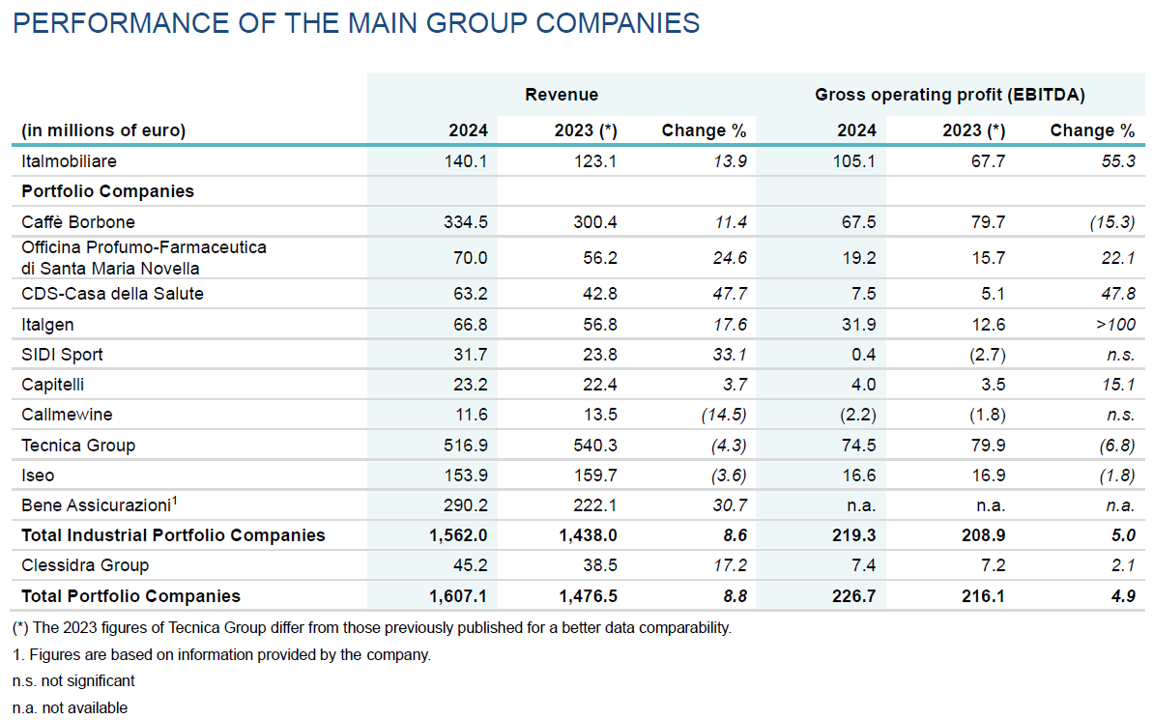

In 2024, the Italmobiliare Group records positive trends linked to the development of its portfolio companies. At a consolidated level, the Group's turnover stands at 701.4 million euro, up 19.7% compared with 2023. The increase is mainly attributable to the excellent performances of Caffè Borbone, CDS - Casa della Salute, Officina Profumo-Farmaceutica di Santa Maria Novella, Italgen and SIDI Sport. Gross operating profit amounted to 157.2 million euro, 58.5% up on the same period last year.

With regard to the valuation of the portfolio investments, it should be recalled that in February 2024 the stake in AGN Energia was sold, with a capital gain in the separate balance sheet of Italmobiliare S.p.A. of approximately 40 million euro and a money-on-money return of 1.8x. It should also be noted that during the year the financial investments in CRM Casa della Piada and FiberCop were realized.

At December 31, 2024, Italmobiliare's Net Asset Value was equal to 2,215.8 million euro, recording a positive performance of 6.4% compared with the figure at December 31, 2023.

In light of the year's good results but considering the rapid evolution of an increasingly challenging geopolitical context, the Shareholders’ Meeting approved the distribution of a dividend of 0.90 euro per share (+12.5% compared to the ordinary dividend distributed in 2023, which was 0.80 euro per share).

“In 2024 – underlines the Chairman, Laura Zanetti – we continued the path towards the net-zero emissions target by 2050, with a climate strategy aligned with the Paris Agreement, thanks to the guidance of the Science Based Targets initiative. Furthermore, we have multiplied our efforts on all other strategic lines, from the promotion of a solid safety culture starting from management leadership to the development of human capital through professional growth, inclusion and gender equality.”

"In 2025, we will focus on further developing our diversified portfolio of Italian industrial excellence, on the one hand supporting our companies in carefully monitoring production chains and international distribution channels, on the other hand providing them with the tools and resources necessary to intensify the path of organic and inorganic growth,” commented Carlo Pesenti, CEO of Italmobiliare.

The performance in the first quarter of 2025 was also positive: during the period, aggregate Group revenue was up by over 14% thanks to growth in all the industrial portfolio companies. The NAV remained stable and above 2.2 billion euro, and cash stood at a positive 273.8 million euro — a significant reserve that enables the company to seize potential opportunities and continue supporting its Portfolio Companies by providing, where necessary, the resources required to accelerate both organic and inorganic growth.